Monthly Archives: April 2018

Root Causes of Sales Reps not meeting quota

I had an “aha!” moment a week or so ago reading through a thread on LinkedIn with a prompt: “Salespeople are getting worse.”

Why are only 53% of Account Execs (Reps) making quota? This stat comes from a CSO Insights report from Miller Heiman.

Reading through the extensive list of comments on the thread one finds many, many, MANY thoughts on what the problem might be.

- Lack of understanding about the Customer’s:

- business fundamentals

- buying strategy

- needs and desired outcomes

- service and support expectations

- need for tailored solutions

- emotional or intuitive buying responses

- Company

- unrealistic quotas, not based on benchmarks or historical data

- Rising quotas

- unhealthy growth expectations

- goals not based in reality

- goals inconsistent or not communicated

- Weak vision

- Scattered products

- No GTM strategy

- Poor culture

- Hiring / Retention

- no methodology

- no pre-assessment or vetting of candidates

- Over-hiring

- More reps fighting for same attention

- Career development

- Sales Training

- how to sell at the company- sales process

- Reps don’t want to adapt or learn

- Should cover planning, thoughtfulness, positioning, analysis of decision-making, competition

- Should include coaching and continuous learning

- Fundamentals for reps and leaders

- Ability to pivot on changes in industry

- Different models for sales supply chains

- Sales AND management training for managers

- Manager coaching training, both sales and management

- Product Training

- time, support and tools to understand product

- Effectiveness of product training

- Market and Environment

- Product offering meets actual need in the market

- Changes to demographics, technology, buyer behavior and expectations

- Digital disruption

- Empowered and informed buyers

- Sales Management

- VPs coaching DOSs coaching AEs

- Not open-minded to feedback or willing to change strategy

- Don’t know how to sell

- Obsessed with meaningless metrics

- “Blowtorch” management

- Sales Reps

- don’t want to work, marketing has made them lazy

- Scared of the phone

- Ability to challenge the buyer’s thinking

- Don’t do proper follow up

- Too focused on social selling

- Process

- Lots of gurus selling theory

- Picking the RIGHT process

- Funnel / pipeline problems

- Cycles have changed

- Need a holistic analysis of the process

- Need to automate the 64% of non-selling time

- Product

- doesn’t work, not viable

- pricing is wrong

- Sales Ops

- use data and data science to reassess strategy and improve

- Sales Ops identify trends not seen by Reps

- Stop seeing Sales Ops as overhead

- Doesn’t even exist in many orgs

That’s from ONE POST!

My question and “aha!” moment: who is analyzing all this to get to the 20% of these causing 80% of the gap? Which are Root Causes and which are Symptoms? Is anybody even doing correlation analysis (the first step) to see which of these might be root causes? I suspect there is a lot of guessing and tossing darts going on.

In a future post I’ll talk about some of the geeky details of how we answer these questions.

How Learning drives value: Kirkpatrick meets 4DX

So how do you know that your Learning and Development efforts are paying off?

I had a conversation with a Sales Operations team a while back, asking whether they saw any correlation between the sales training that was being required (and tied to comp!) and actual sales performance. They said they’d never been able to show even a correlation between learning and actual results.

So is sales training a complete waste of effort and resources?

This is the double-edged sword we swing as L & D professionals when we try making the business case for learning. Part of the problem is trying to correlate learning “completions” directly with sales bookings, deal size or other metrics that drive the business. It’s too large of a leap.

A possible solution is to break the problem down, and this is where The Four Disciplines of Execution (4DX) comes in. If you are not familiar with this book or methodology, you can check out a quick introduction by author Chris McChesney on YouTube.

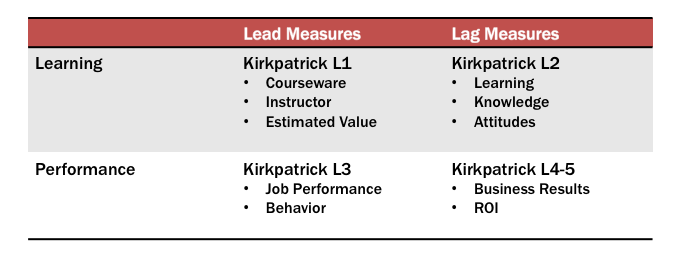

The Second Discipline, the discipline of Leverage, tells us that for every Wildly Important Goal, there are “lead” activities that we control that can drive, influence or predict the “lag” results– those results beyond our direct control we only know about after they occur– like quarter sales numbers. By focusing on the “leads” (and measuring the leads and lags) we can clearly see our impact on the outcomes. This assumes, of course, that the lead activities actually determine, or at least predict, the lag results.

For the Learning professional, what are the leads and lags? And how do these translate to the leads and lags for our target audiences? By splitting Learning Leads and Lags from Performance Leads and Lags we get the following matrix, which maps nicely to Kirkpatrick’s Evaluation model:

Working backwards from L4 in the lower right quadrant, we need to show that performance of the selected Lead measures (L3) actually drive, influence or predict the L4 business results. This is often the job of Sales Operations, using statistical correlation or regression analysis to show the connection.

We can use the same tools in the Learning row to show that L1 Evaluations of courseware quality, instructor prep and delivery and applicability of the content to actual job duties drives L2 Learning outcomes and improvement.

We only need to show that L2 drives, influences or predicts L3 performance lead metrics to indicate the value to the business. Our mistake has been trying to show a relationship between L1 and L4 directly without considering the intervening levels.

Performance is the key pivot point here: I’ll have more to say on the actual methods for determining these connections between Leads and Lags, and from Learning Lags to Performance Leads in future posts.

15 questions to help guide Learning & Performance strategy

Over the last several years, as I’ve moved from individual contributor to manager and director-level roles, I’ve had to think more strategically about what learning and performance mean in the context of overall organizational growth. These ideas have been forged in the last five years in late-stage, high growth startups. In these companies, L & P strategy is often an afterthought, or “something that HR does.”

The following is a condensed list of my strategic planning questions:

- What would a 1% increase in Sales productivity (or customer retention) mean to your bottom line? 2%? 5%?

- Do you know whether your investment in learning is paying off? How do you (or would you) know?

- What’s the best way to invest your limited L & P budget?

- How do you measure the 90% of learning that happens outside formal e-Learning, virtual and classroom events?

- How are you embedding learning into individual work streams?

- Are you asking the right questions in your course evaluation surveys?

- What is the shelf-life of your e-Learning content? How are you updating and maintaining it?

- Do you have a learning content governance model? What is the value-add of quick access to accurate content?

- Do you have a job-role competency model? Is it used across recruitment, talent management, performance and learning systems?

- Which stages of ADDIE do you skip or gloss over?

- What are your top performers doing better, differently, more of or less of than average performers?

- Do you use proficiency levels and rubrics to guide both assessment and development of individuals?

- How is performance improvement built into your organization’s day to day work?

- How are you leveraging your learning resources for content marketing?

- How is your L & P strategy aligned with overall company goals and objectives?

- Is training part of your product development, go to market and commercialization planning?

In following posts I’ll tackle some of these questions in more depth, to get at the critical considerations for each and their relationship and cross-dependencies.

Recent Comments